CBP 434 2020-2026 free printable template

Show details

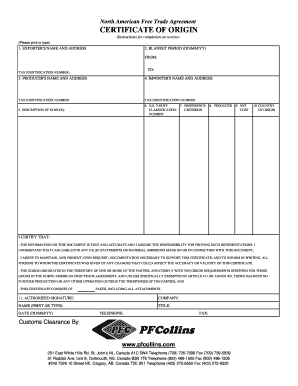

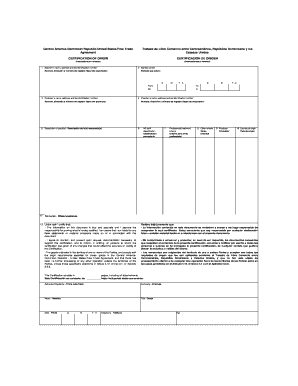

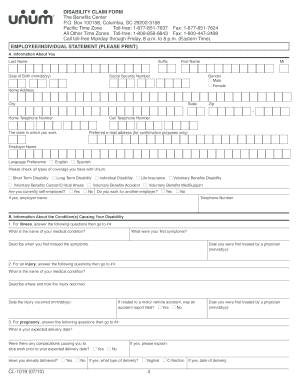

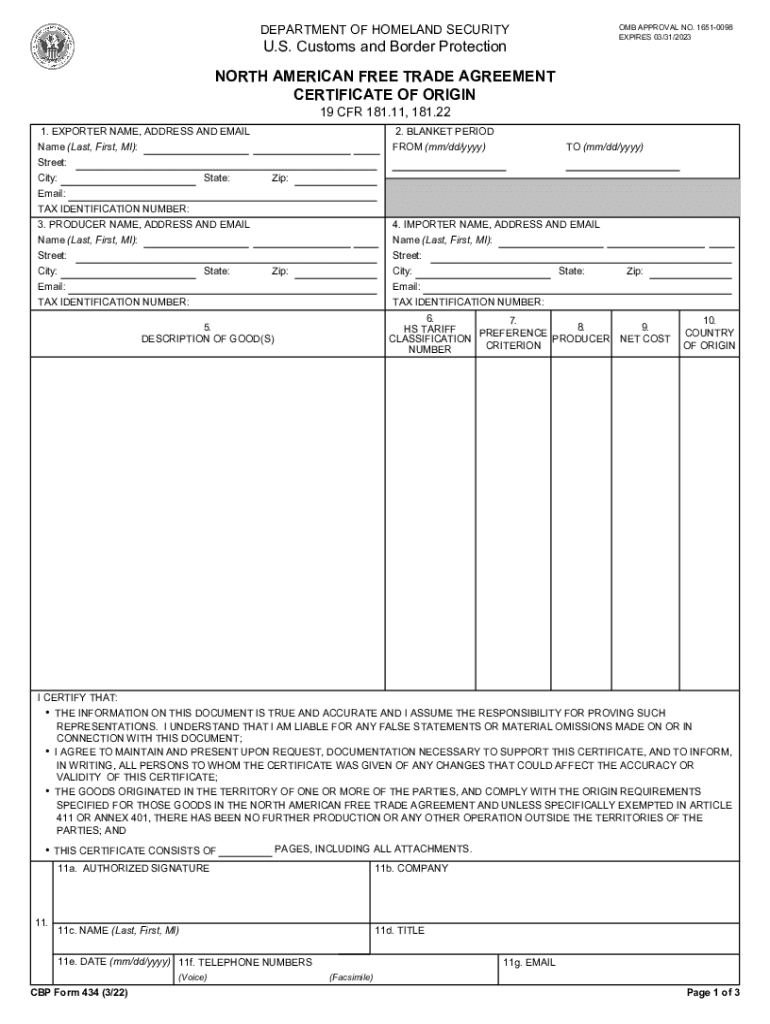

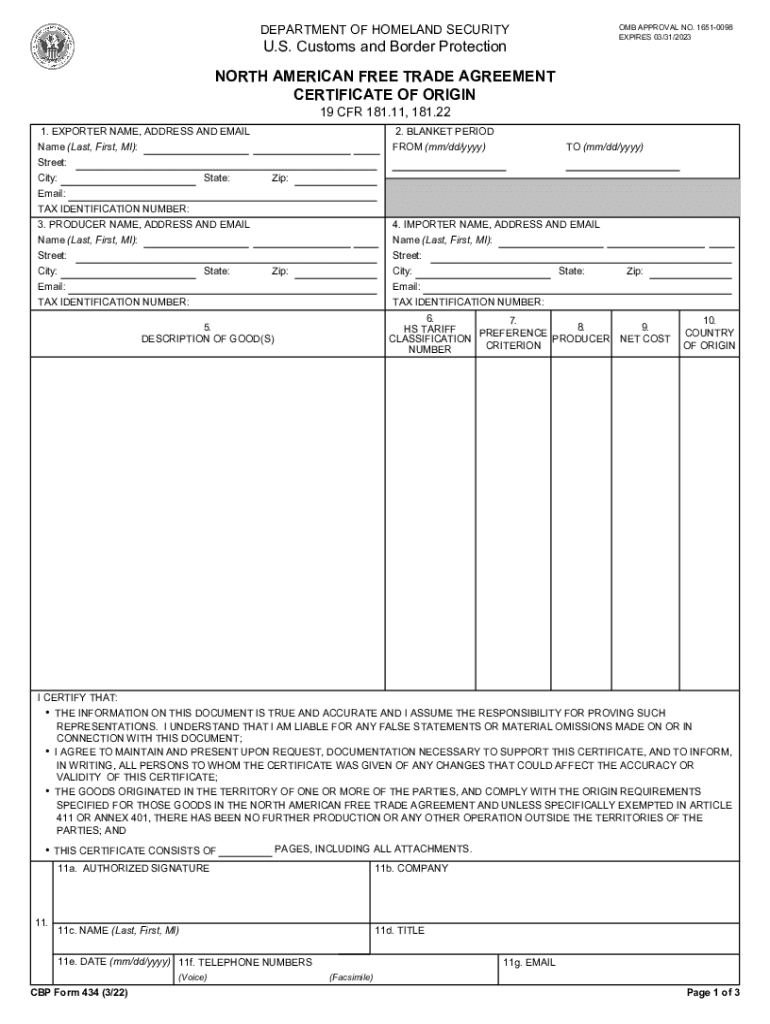

COMPANY 11c. NAME 11d. TITLE 11e. DATE mm/dd/yyyy 11f. TELEPHONE NUMBERS Voice CBP Form 434 11/16 11g. DEPARTMENT OF HOMELAND SECURITY U.S. Customs and Border Protection OMB No. 1651-0098 Exp. 04-30-2020 NORTH AMERICAN FREE TRADE AGREEMENT CERTIFICATE OF ORIGIN 19 CFR 181. 11 181. 22 1. EXPORTER NAME ADDRESS AND EMAIL 2. BLANKET PERIOD FROM mm/dd/yyyy TAX IDENTIFICATION NUMBER 3. PRODUCER NAME ADDRESS AND EMAIL 4. IMPORTER NAME ADDRESS AND EMAIL HS TARIFF PREFERENCE CLASSIFICATION PRODUCER...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign north american trade agreement form

Edit your form 434 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate trade origin agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of origin online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit us customs and border protection form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CBP 434 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cbp form 434

How to fill out CBP 434

01

Obtain the CBP Form 434 from the U.S. Customs and Border Protection website or office.

02

Enter the full name and address of the individual or business submitting the form at the top of the document.

03

Provide the detailed description of the merchandise being imported, including quantity, value, and any relevant identifying information.

04

Fill in the country of origin for the merchandise.

05

Indicate the applicable tariff classification codes for the items.

06

Sign and date the form to certify that the information is correct.

07

Submit the form along with any required customs documentation to the appropriate CBP office.

Who needs CBP 434?

01

Individuals or businesses that are importing goods into the U.S. for personal or commercial purposes.

02

Any entity that needs a record of declarations for imported goods accepted by U.S. Customs and Border Protection.

03

Importers seeking to claim drawback or refund on duties or taxes paid, who need to document their claims accurately.

Fill

cbp form 434 fillable

: Try Risk Free

People Also Ask about trade agreement form australia

Is NAFTA trade agreement still in effect?

NAFTA remained in force until USMCA was implemented.

What is the current status of NAFTA?

The United States-Mexico-Canada Agreement (USMCA) entered into force on July 1, 2020. The USMCA, which substituted the North America Free Trade Agreement (NAFTA) is a mutually beneficial win for North American workers, farmers, ranchers, and businesses.

Is Nafta certificate of origin required?

The NAFTA Certificate of Origin is only needed for shipments to another NAFTA country to qualify for preferential tariff treatment under the NAFTA rules of origin. A certificate is not needed if the shipment does not qualify for preferential treatment, or if a NAFTA claim will not be made on the imported goods.

Who needs NAFTA certificate?

The NAFTA Certificate of Origin is only needed for shipments to another NAFTA country to qualify for preferential tariff treatment under the NAFTA rules of origin. A certificate is not needed if the shipment does not qualify for preferential treatment, or if a NAFTA claim will not be made on the imported goods.

Who provides NAFTA certificate?

NAFTA Certificate of Origin | U.S. Customs and Border Protection.

Are NAFTA certificates still required?

Once an exporter has determined the product qualifies for NAFTA, the exporter needs to fill out a NAFTA Certificate of Origin UNLESS the product going to Canada or Mexico is valued at LESS than $1,000 USD.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit north american trade agreement online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your nafta certificate of origin template to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit cbp 434 form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign certificate origin on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out nafta certificate origin cbp form 434 on an Android device?

Use the pdfFiller mobile app to complete your nafta form canada on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is CBP 434?

CBP 434, also known as the 'Application for Exportation of Natural Resources,' is a form used by U.S. Customs and Border Protection to document and regulate the exportation of specific natural resources from the United States.

Who is required to file CBP 434?

Individuals or entities exporting certain natural resources, such as timber or minerals, from the United States are required to file CBP 434.

How to fill out CBP 434?

To fill out CBP 434, exporters must complete the form with accurate details including their personal information, description of the goods, quantity, and value, and submit it to CBP prior to exportation.

What is the purpose of CBP 434?

The purpose of CBP 434 is to provide regulatory oversight of the exportation of natural resources, ensuring compliance with U.S. laws and proper documentation of exported goods.

What information must be reported on CBP 434?

CBP 434 requires reporting of information such as the exporter’s details, a detailed description of the natural resource being exported, quantity, value, and any applicable export license or permit numbers.

Fill out your CBP 434 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nafta Forms is not the form you're looking for?Search for another form here.

Keywords relevant to cbp form 434 certificate origin

Related to form cbp

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.